west virginia retirement taxes

Marginal Income Tax Rates. Teachers Retirement System West Virginia Public Employees Retirement System and Federal Retirement Systems Title 4 USC 111.

Tax Bills Passed During 2021 West Virginia Legislative Session Frost Brown Todd Full Service Law Firm

With a few exceptions if a source of income is taxable at the federal level.

. Wages are taxed at normal rates and your marginal state tax rate is 590Overview of West Virginia Retirement Tax Friendliness. West Virginia Property Tax Breaks for Retirees. As you enter retirement dont let confusion about your taxes keep you from enjoying everything Virginia has to offer.

Oregon taxes most retirement income at the top rate while allowing a credit of up to 7050 for retirement distributions. Low Cost of Living 2. 4 Full Seasons Cons of Retiring in West Virginia 1.

Plenty of Outdoor Activities 3. Withdrawals from retirement accounts are partially taxed. State fuel taxes in West Virginia rank toward the bottom when compared to all US.

West Virginia personal income tax law provides a modification reducing federal adjusted gross income for certain retirement income received from the WV State Police retirement system. Continue to the Tax Calculator. Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the West Virginia Tax Divisions primary mission is to diligently collect and accurately assess taxes.

Missouri Montana Nebraska New Mexico Rhode Island Utah. People who are 65 years of age or older or disabled are entitled to an exemption from property taxes on the first 20000 of. Table of Contents.

For questions or concerns related to tax refunds or payments please contact the State Tax Department Taxpayer Services Division at 304-558-3333 or 1-800-982-8297. The tax on both gasoline and diesel is 2050 cents per gallon 13th- and 12th. Pros of Retiring in West Virginia 1.

Starting with the 2020 tax year. In addition employees are offered the voluntary opportunity to participate in the West Virginia Retirement Plus Program a supplemental retirement plan designed to provide an extra savings. Thanks in part to the advocacy campaign by AARP West Virginia Mountain Staters will enjoy a phaseout of a state tax on Social Security benefits.

Retirement Income and Social Security Exemption. Tax Information and Assistance. West Virginia Gas Tax.

For tax years beginning on and after January 1 2018 all military retirement income from the regular Armed Forces Reserves and National Guard is exempt from WV income tax. The total amount of any benefit including. 4101 MacCorkle Avenue SE Charleston West Virginia 25304 Telephone 304 558-3570 or 800 654-4406 Nationwide Fax 304 957-7522 Email.

304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. West Virginias highest income tax bracket is 65 and the lowest is 3. If you have any questions concerning this Tax Calculator please call 304 558-3333 or 1-800-982-8297.

Taxpayers over 65 may exclude the. West Virginia allows for a subtraction of up to 2000 of retirement income from West Virginia Teachers Retirement West Virginia Public Employees Retirement System or Federal.

Which States Are Best For Retirement Financial Samurai

Faced With Population Decline West Virginia Looks To Cut Income Taxes Npr

Fiscal Facts Tax Policy Center

How Every State Taxes Differently In Retirement Cardinal Guide

West Virginia Legislature S Joint Standing Committee On Pensions And Retirement Hears Cost Of Living Increase Presentations Wv News Wvnews Com

Retiring These States Won T Tax Your Distributions

Faced With Population Decline West Virginia Looks To Cut Income Taxes Npr

States That Don T Tax Military Retirement Turbotax Tax Tips Videos

12 States That Don T Tax Social Security Or 401 K Ira Retirement Income

West Virginia Legislature S Joint Standing Committee On Pensions And Retirement Hears Cost Of Living Increase Presentations Wv News Wvnews Com

Taxes In Retirement How All 50 States Tax Retirees Kiplinger

13 States That Tax Social Security Benefits Tax Foundation

How Taxes Can Affect Your Social Security Benefits Vanguard

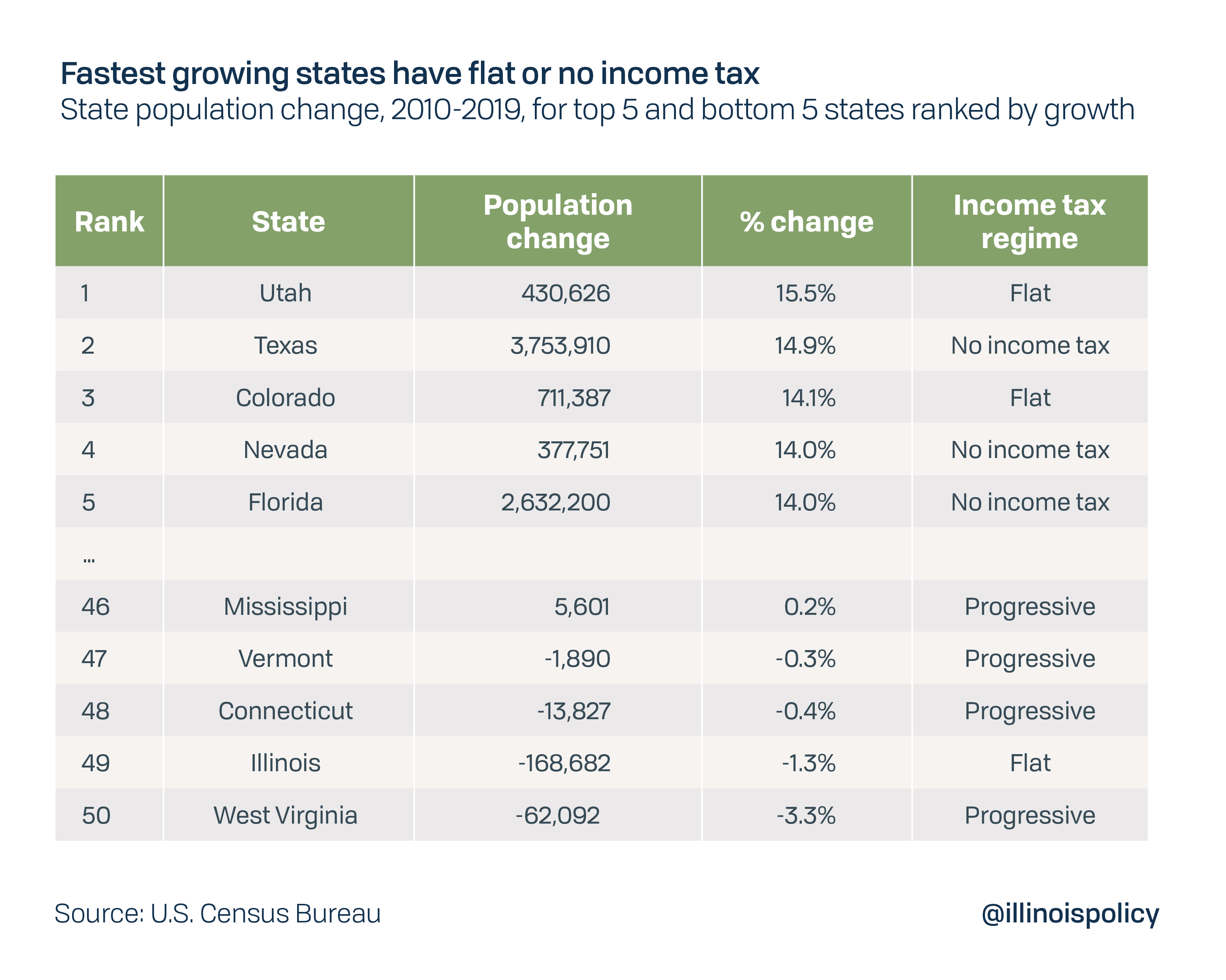

Every State With A Progressive Tax Also Taxes Retirement Income

Where S My West Virginia Wv Tax Refund West Virginia Tax Brackets

Plan Ahead To Optimize Your Tax Strategy In Retirement

The Most Tax Friendly States For Retirees Vision Retirement

State Individual Income Tax Rates And Brackets Tax Foundation